100,000,000 Dai later...

Seeking Yield by Staked - Issue 40: 📈 100MM Dai Debt Ceiling Reached, 🖥️ Validating on Polkadot webinar, ✍️ Ethereum 2.0 Update #3, 📊 Current Yields, & More

This is the fortieth issue of Seeking Yield by Staked, a weekly update about the most interesting things happening in crypto asset staking and lending.

📈 100MM Dai Debt Ceiling Reached

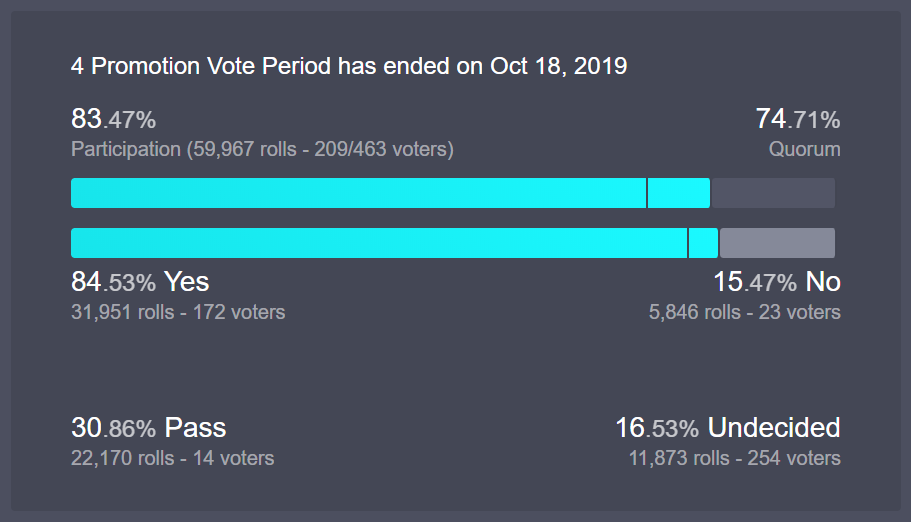

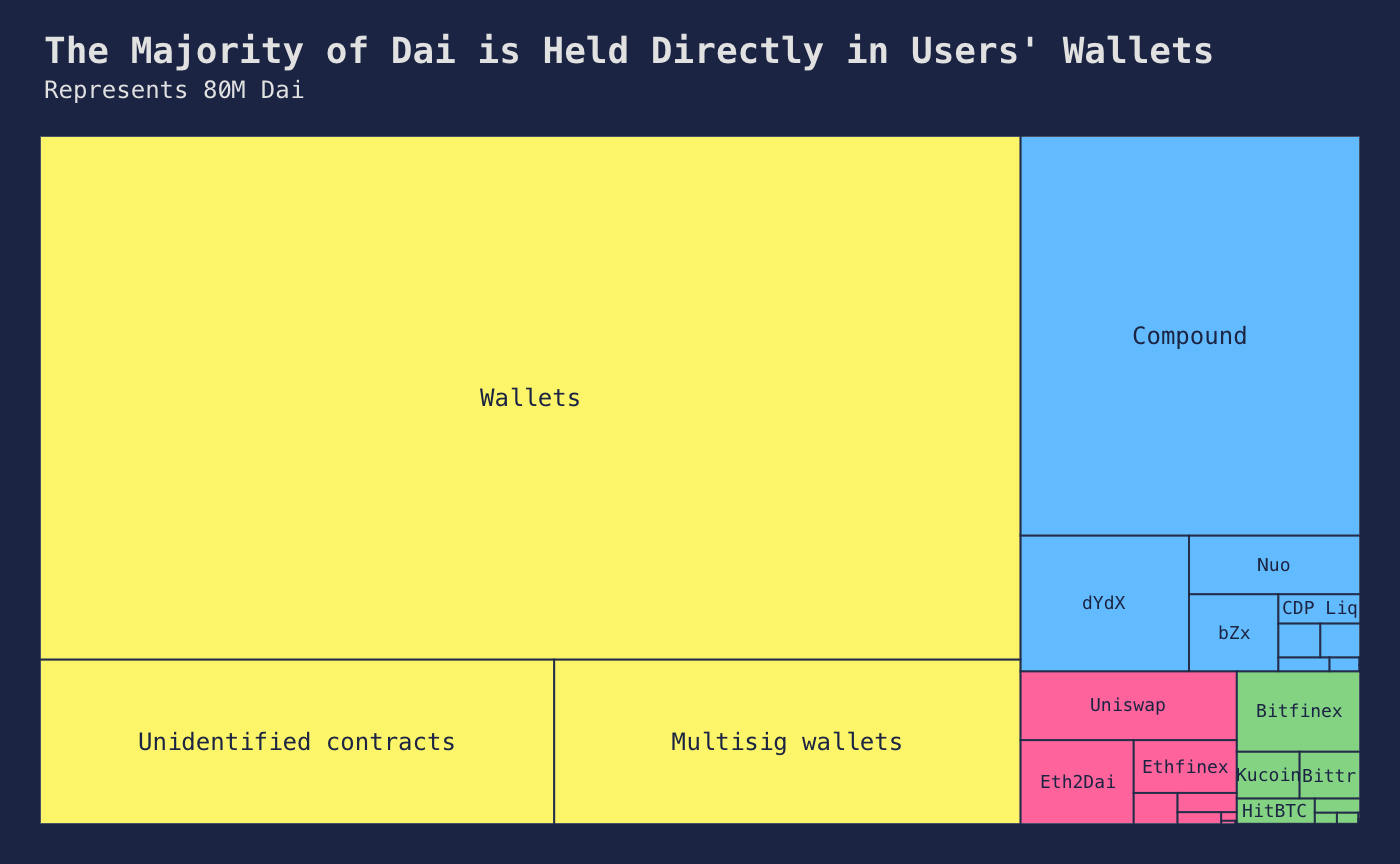

Earlier this week, MakerDAO reached the current debt ceiling of 100 million Dai.

This feat comes nearly two years after the launch of the system and less than two weeks until the transition to Multi-Collateral Dai on November 18th.

Graph: Coin Metrics

As a result, the Maker Foundation Interim Risk Team placed an Executive Vote into the voting system, which enabled the community to vote for a new Debt Ceiling of 120 million Dai. The vote passed and the change was implemented earlier today.

Keep an eye on the MakerDAO debt ceiling moving forward! 👀

Learn more:

👉 Try the Robo-Advisor for Yield today!

👉 Reply directly to this email or find time here to set up a RAY demo.

🖥️ Validating on Polkadot webinar

The Polkadot mainnet is approaching. Tune in on Tuesday, November 12th, at 15:00 UTC (10 am EST) for a webinar on everything you need to know about Polkadot validation.

On the webinar, Joe and David from Parity Technologies will be covering Polkadot validation, nominators, economics, account setup, and validator infrastructure.

Additionally, Staked CEO Tim Ogilvie will be presenting on the key risks and opportunities when running nodes, and how Staked architects infrastructure to ensure both reliability and security.

Everyone that RSVPs and joins the webinar will receive one $KSM (Kusama).

Register now!

Learn more:

👉 Register for the “Validating on Polkadot” webinar

👉 Sign up to get notified when Polkadot staking launches

✍️ Ethereum 2.0 Update #3

Danny Ryan from the Ethereum Foundation recently published the third Ethereum 2.0 update, highlighting the latest as phase 0 becomes increasingly imminent.

A few key takeaways:

Fork choice defenses have been hardened in response to attack vectors raised to ensure that the network can remain stable even under adverse conditions, such as a large attacker, major network outage, etc.

A new challenges.ethereum.org has been released. This website is a central source for all of the current bounties hosted by the Ethereum Foundation and/or related to Ethereum R&D. Featured bounties span over a number of areas, including finding vulnerabilities in existing Ethereum infrastructure to finding collisions in new hash functions.

Shigeo Mitsunari has received a grant for the Herumi library for ultra-fast BLS signature operations. This grant is intended to bring the libraries up to speed with the new BLS standard, as well as to help accomplish some more practical items for eth2 usability.

Phase 0 is near. Onward!

Learn more:

👉 Reply to this email to learn more and/or get notified when ETH staking launches!

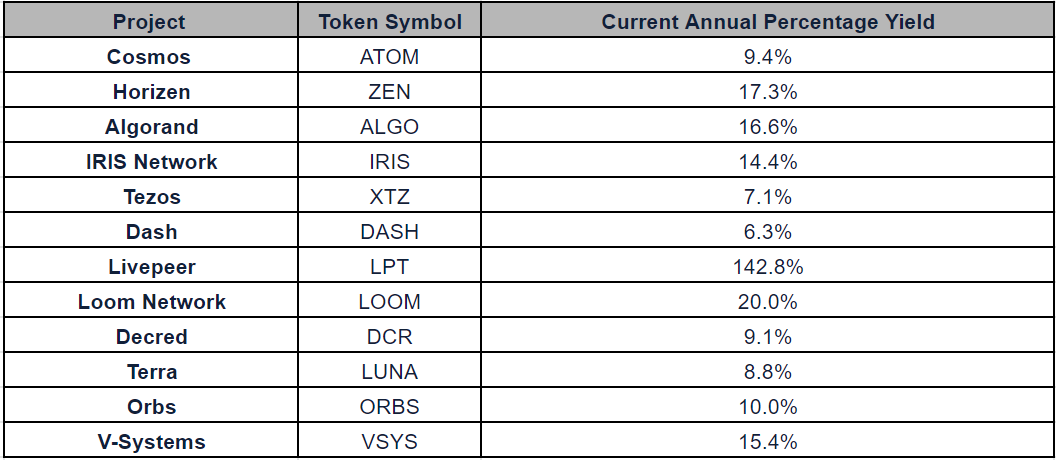

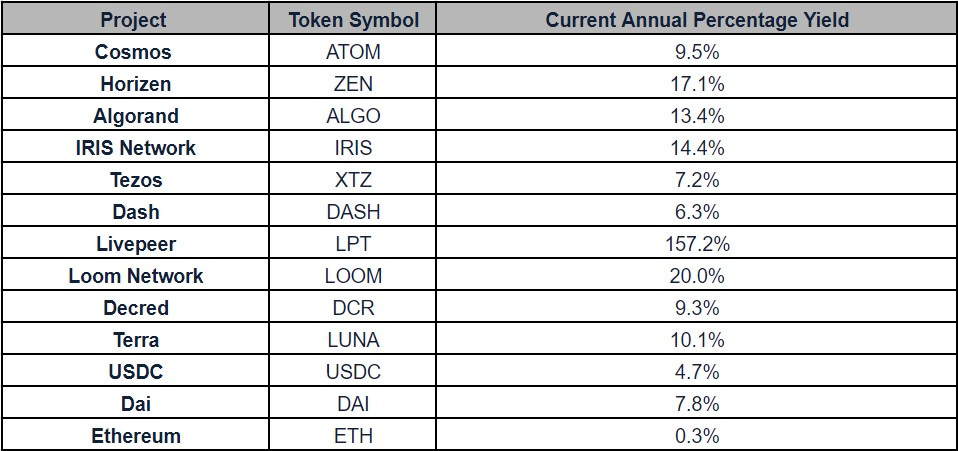

📊 Current Staking Yields

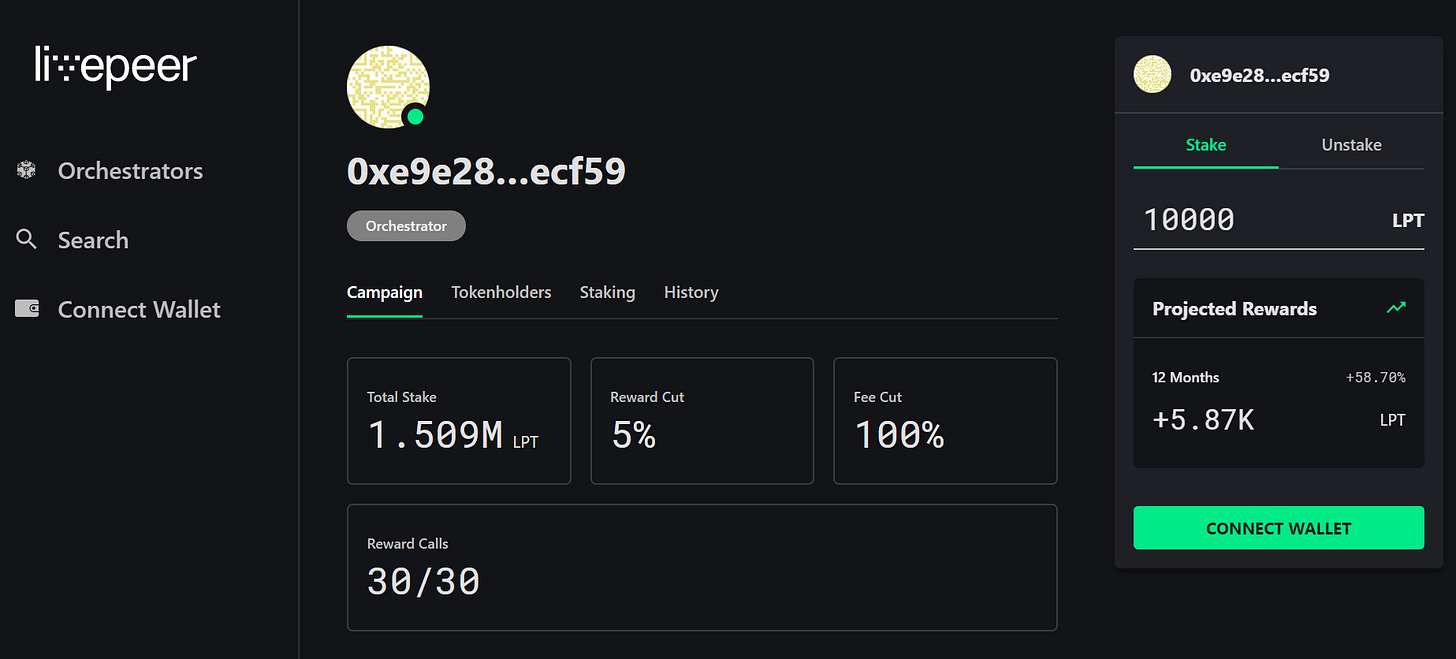

Staked currently supports 14 different proof of stake crypto assets including Cosmos, Algorand, Tezos, Dash, Decred, Orbs, Horizen, Livepeer, EOS, Factom, Loom, Iris, Terra, and V-Systems.

Learn more:

👉 Ready to get started or have questions? Reply directly to this email.

👉 Find time to speak with someone from the Staked team here.

📊 Robo-Advisor for Yield (RAY)

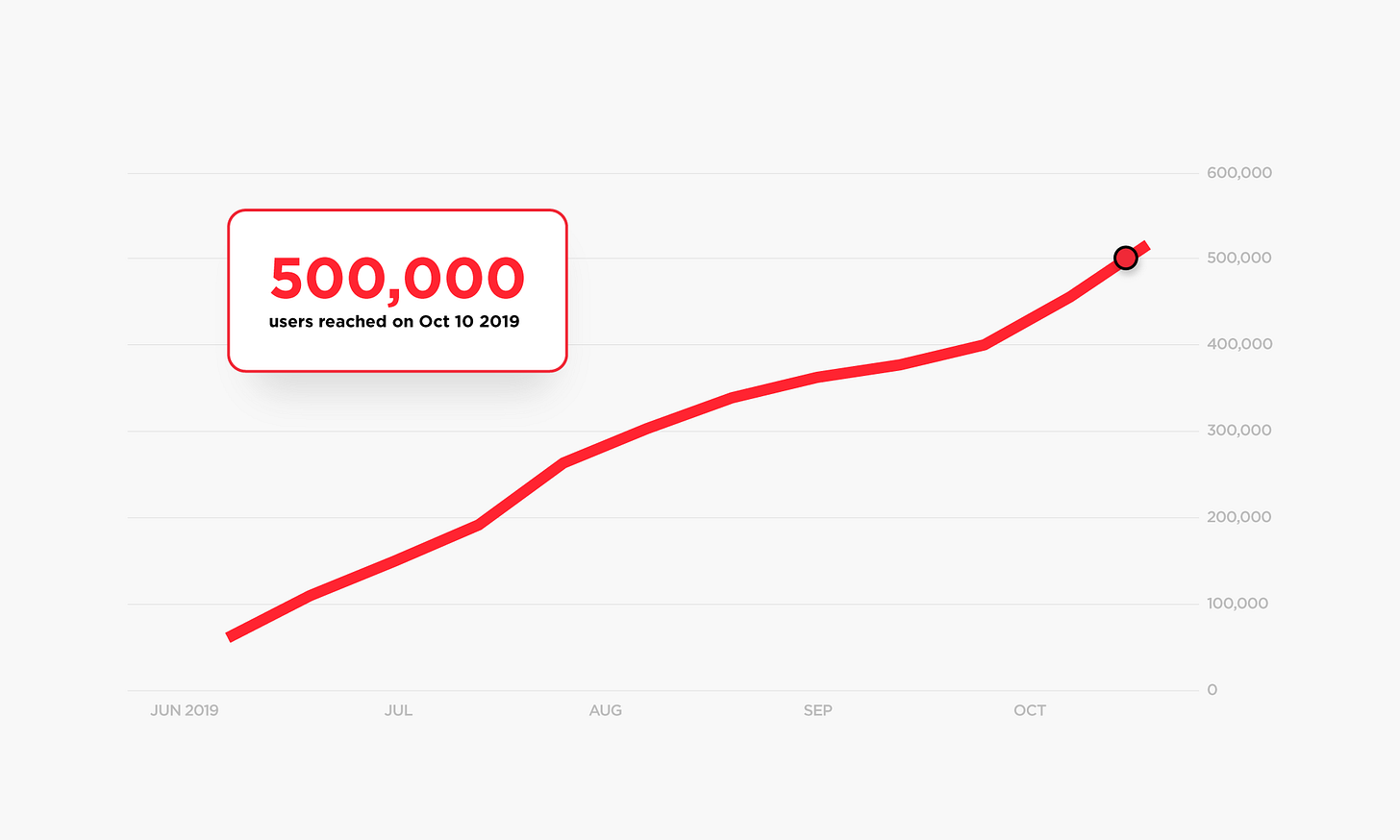

Currently live on the Ethereum mainnet, the Robo-Advisor for Yield (RAY) is the easiest way to earn the highest yield on your ETH, DAI, and USDC holdings.

Learn more:

👉 Reply directly to this email or find time here to set up a RAY demo.

👉 Try the Robo-Advisor for Yield today!

📜 Staked Developer Docs

Interested integrating the Robo-Advisor for Yield (RAY) and/or staking-as-a-service into your business today? Check out our developer documentation!

Integrating RAY is as simple as dropping in a few lines of code. Furthermore, partners looking to offer staking-as-a-service are able to integrate with our staking infrastructure directly through our API services.

Learn more:

👉 Staked Developer Documentation

👉 Reply to this email to speak with the Staked team about getting started today!

About Staked

Staked helps institutional investors reliably and securely compound their crypto by 5% — 100% annually through staking and lending. Staked runs validation nodes for proof-of-stake currencies and offers access to on- and off-chain lending options that provide an annualized yield of in-kind currency. Staked’s investors include Pantera Capital, Digital Currency Group, Coinbase Ventures, Winklevoss Capital, Fabric Ventures, Global Brain, and other leading crypto investors.

Website | Twitter | LinkedIn | Medium | Newsletter | Careers | Telegram