⛓️ Seeking Yield by Staked - Issue #30

✅ SKALE Fuji Devnet Goes Live, ⚙️ Solana Supports Libra’s Move VM, 🔬 More Information on tBTC, ⚖️ ICON Pre-Voting Period, & 📊 Current Staking and Lending Yields

This is the thirtieth issue of Seeking Yield by Staked, a weekly update about the most interesting things happening in crypto asset staking and lending.

✅ SKALE Fuji Devnet Goes Live

SKALE Labs recently announced the launch of the Fuji devnet, a decentralized developer network run by a global community of validators.

The Fuji release will support all principal aspects of SKALE functionality, such as smart contract scaling, decentralized storage, and interchain transfer, to ultimately facilitate a smoother deployment process for decentralized applications.

“With the launch of Fuji DevNet, we are introducing a project into the community that is fully focused on building real technology and solving Ethereum’s largest issue of scalability while providing developers a configurable and customizable framework for dApp development,” elaborated Jack O’Holleran, CEO and Founder of SKALE Labs.

We are thrilled to be supporting SKALE and excited by the launch of the Fuji devnet.

Learn more:

👉 SKALE Labs Fuji Devnet Goes Live Fully Decentralized With Top Validator Partnerships

👉 Get notified when SKALE staking launches!

⚙️ Solana Supports Libra’s Move VM

Following the announcement of Facebook’s Libra project, the Solana team recognized that Move, a new programming language developed to provide a safe and programmable foundation for the Libra Blockchain, would be able to share compatibility with Solana.

Recently, the Solana team has announced support for the Move VM on Solana. Projects built with Move can now utilize the transactional speed and capacity of the Solana network.

Given the amount of developers worldwide that may potentially utilize Move VM, supporting the new language could prove to be lucrative for Solana.

We are proud to support Solana and look forward to mainnet launch!

Learn more:

👉 Solana Now Supports Libra’s Move VM

👉 Get notified when Solana staking launches!

🔬 More Information on tBTC

Keep, Summa, and the Cross-Chain Group recently announced tBTC, a trust-minimized bridge between Bitcoin and Ethereum. tBTC is major milestone for Keep, as it will be the first decentralized application launched on the network.

tBTC will go live shortly after the Keep platform does. Furthermore, tBTC will leverage the Keep work token, random beacon, and threshold ECDSA keeps. Keep’s stakers will provide the security backing tBTC and earn tBTC signing fees, as well as revenue from running the random beacon and other decentralized applications launched on Keep.

Be sure to check out the post below by Matt Luongo to learn more about next steps for tBTC, including onboarding builders to a private testnet, updating the price feed mechanism, a public demo, and more.

Learn more:

👉 Bridging Bitcoin and Ethereum

👉 Get notified when Keep Network staking launches!

⚖️ ICON Pre-Voting Period

The ICON Pre-Voting period has started and will continue until September 24, 2019, intending to provide an opportunity to stabilize the network prior to launch. During the Pre-Voting Period, 3 million ICX will be given away by the ICON Foundation.

ICX holders can utilize ICONex to stake and vote for P-Rep candidates. More ICONex capabilities will be available upon the completion of the Pre-Voting period.

Thus, the ICON network continues to progress and move towards decentralization.

Learn more:

👉 Voting for Staked as an ICON P-Rep

👉 ICONSENSUS: Announcing P-Rep Pre-Voting

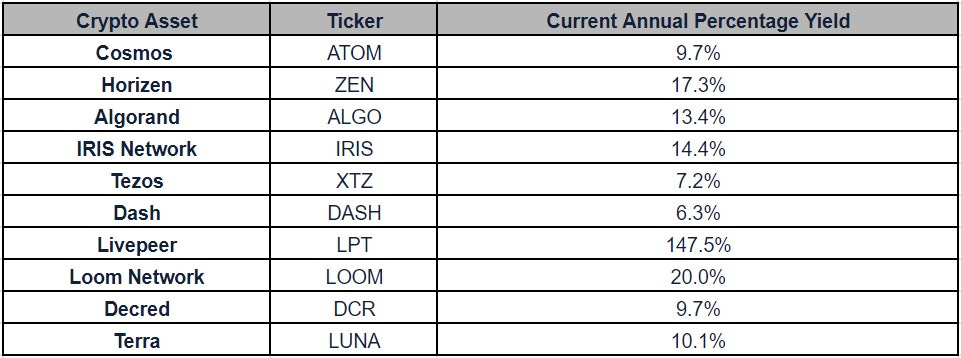

📊 Current Staking Yields

Staked currently supports Cosmos (ATOM), Terra (LUNA), Horizen (ZEN), Loom Network (LOOM), Tezos (XTZ), Livepeer (LPT), Dash (DASH), EOS (EOS), Factom (FCT), Decred (DCR), IRIS Network (IRIS), Terra (LUNA), and Algorand (ALGO).

Have questions? Find time to speak here.

Sign up here for more on staking with Staked!

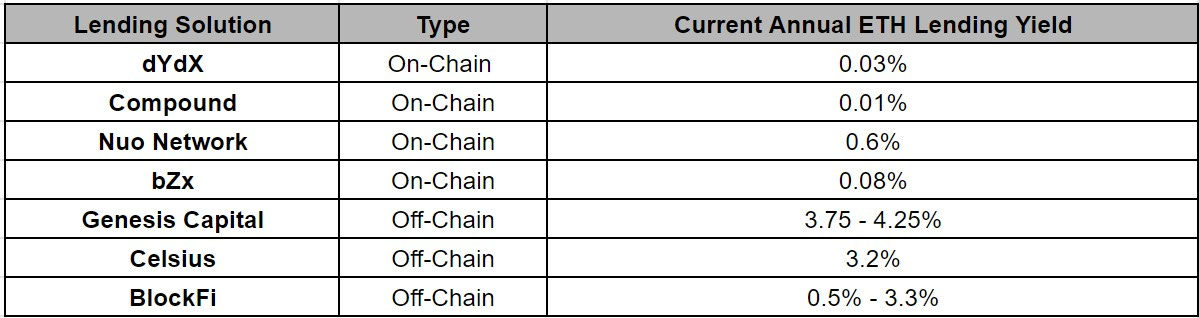

📊 Current ETH Lending Yields

There are both on-chain and off-chain crypto asset lending solutions.

Below are various crypto asset lending solutions and annual ETH lending yields.

Sign up here to learn more about lending with Staked!

About Staked

Staked helps institutional investors reliably and securely compound their crypto by 5% — 100% annually through staking and lending. Staked runs validation nodes for proof-of-stake currencies and offers access to on- and off-chain lending options that provide an annualized yield of in-kind currency.

If you enjoy Seeking Yield or are a fan of what we are building at Staked, give us a shout on Twitter, LinkedIn, or tell your friends and colleagues.

Website | Twitter | LinkedIn | Medium | Newsletter | Careers