⛓️ Seeking Yield by Staked - Issue #34

🐦 Kusama Chain Candidate 2, 📽️ Livepeer Ecosystem Update, 📈 Substantial Terra Growth, 🛠️ Upgrading to Multi-Collateral Dai, 🎂 Happy Birthday, USDC, & 📊 Current Staking and Lending Yields

This is the thirty-fourth issue of Seeking Yield by Staked, a weekly update about the most interesting things happening in crypto asset staking and lending.

🐦 Kusama Chain Candidate 2

Three weeks after the launch of the Kusama Chain Candidate 1 (CC1), the next phase of Kusama, Chain Candidate 2 (CC2), has been released. This release comes after several key fixes to Polkadot, including the BABE consensus layer.

Though Kusama Chain Candidate 2 is technically a fresh chain and will require all Kusama node operators to upgrade, the transaction history of Kusama CC1 will be injected into Kusama CC2. Ergo, CC2 a not-quite hard fork of CC1.

We are very excited to be supporting Kusama and look forward to the Polkadot mainnet launch!

Learn more:

👉 Sign up to learn more about KSM & DOT staking!

📽️ Livepeer Ecosystem Update

The Livepeer ecosystem is stronger than ever. Below are some of the key takeaways from the recent ecosystem update covering the project’s progress over the last month or so.

Streamflow, the upcoming Livepeer protocol update focused on making the initial alpha public network scalable, cost effective, and reliable, is currently running on an internal test network with high reliability. Below is a dashboard showing probabilistic micropayments tickets being sent, received, and redeemed for one node on the Streamflow internal testnet.

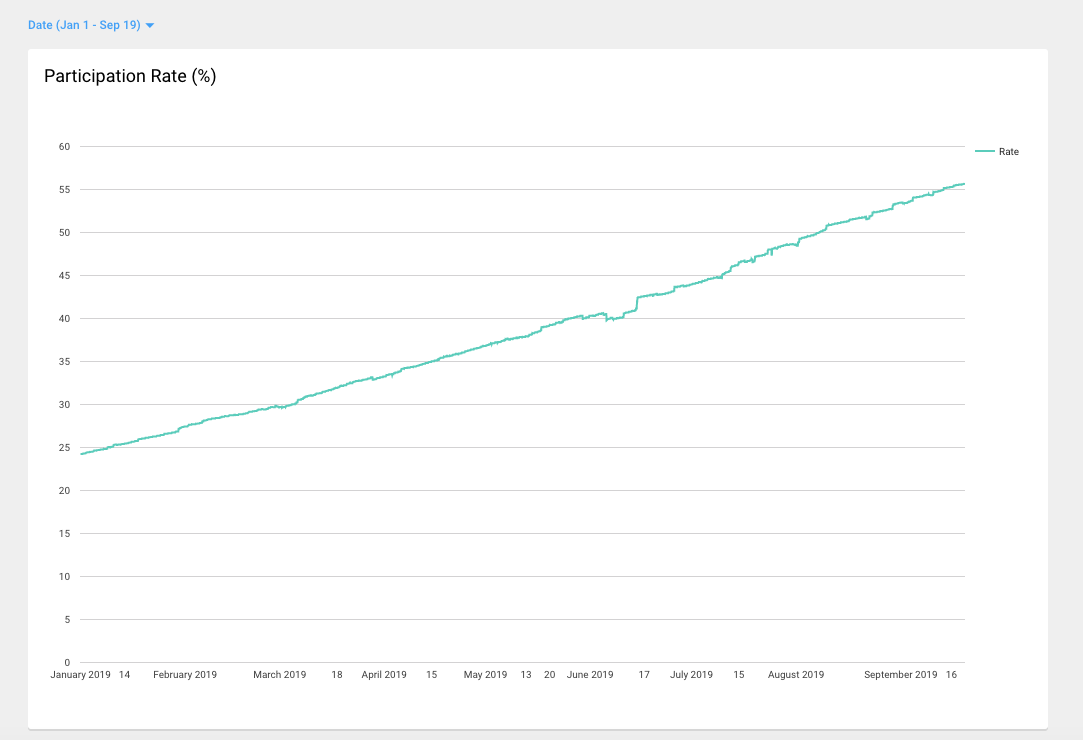

Also during September, the Livepeer participation rate crossed 50%, reaching roughly 55%. For context, the participation rate was slightly less than 25% at the beginning of 2019. See participation rate growth below.

Livepeer’s video developer productization and pilot program was also mentioned in the update. Video streaming application developers in need of transcoding are able to share information here.

We are proud supporters of the Livepeer network and look forward to continued success!

Learn more:

👉 September Livepeer Ecosystem Update

📈 Substantial Terra Growth

This past week, Terra published an update covering the past few months of progress. The update highlights the impressive growth of the protocol, reaching more than 350,000 accounts and 26 million USD of transaction volume since genesis.

During the past few months, Terra has also signed on a number of eCommerce partners including:

Yanolja: Leading Korean accommodation platform with annual GMV of $2bn

Bugs Music: Music streaming service similar to Spotify in Korea

OHOUSE: Korea’s No 1 interior design and furniture platform

More partners, more users!

Thus, Terra is undeniably one of the most prolific projects in crypto. Onward!

Learn more:

👉 September 2019 Terra Community Update

👉 Delegate Terra Luna to Staked

🛠️ Upgrading to Multi-Collateral Dai

MakerDAO recently published some details regarding the required upgrade to Multi-Collateral Dai (MCD) upon it’s release.

It is important to note that holders of Dai, either in a wallet, CDP, or on an exchange, must upgrade when MCD is released (unless the exchange offers to handle this for you). Those who do not upgrade their Dai will be subject to an Emergency Shutdown, which is explained in the post linked below. With that being said, different types of use cases and partners require different upgrade processes.

The Maker Foundation has also published the MCD Upgrade Guide to ensure as smooth of a transition as possible. The guide covers the specifics of migration, upgrading Dai and CDPs, best practices for different types of partners, and MCD integration.

MCD is coming! MCD is coming!

Learn more:

👉 Looking Ahead: How to Upgrade to Multi-Collateral Dai from Single-Collateral Dai

👉 Deposit Dai to the Robo-Advisor for Yield (RAY)

🎂 Happy Birthday, USDC!

This past week, USD Coin (USDC) celebrated it’s first birthday and what a year it has been.

With the first batch of USDC minted on September 10, 2018, the fiat-backed stablecoin has come a long way in the past year, reaching $1B worth of USDC issued.

Below are some of the milestones along the way.

September 2018 - USDC officially launches with wide ecosystem support

October 2018 - Circle and Coinbase launch the CENTRE Consortium

November 2018 - First attestation report on USD reserves backing USDC released

December 2018 - Binance lists USDC as a quote currency pair

January 2019 - USDC crosses $300M market cap

May 2019 - DeFi protocols embrace USDC

July 2019 - USDC crosses $400M market cap

August 2019 - One billionth USDC issued

Thus, USDC has seen some tremendous growth in the past year. Very impressive!

Learn more:

👉 Deposit USDC to the Robo-Advisor for Yield (RAY)

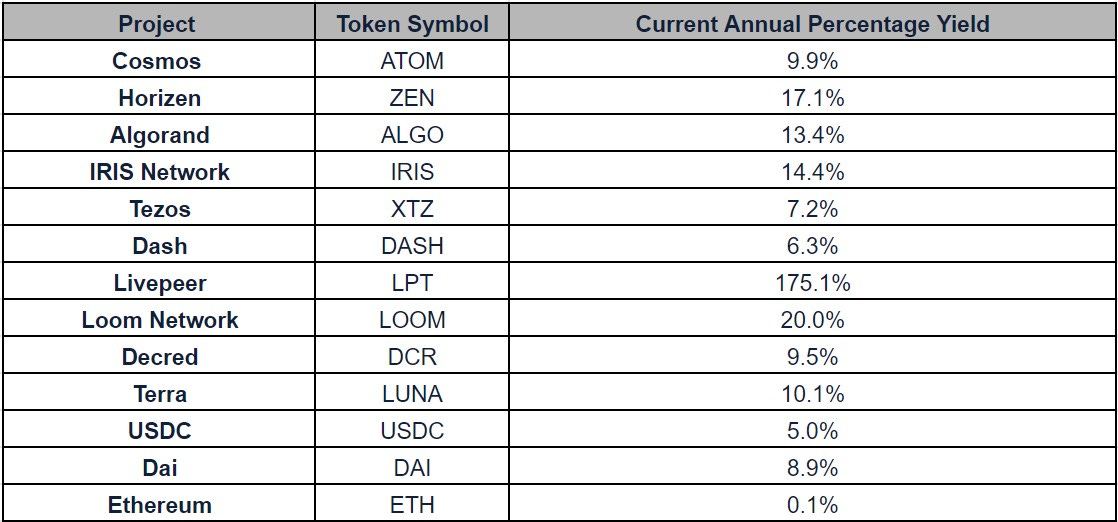

📊 Current Staking & Lending Yields

Staked currently supports 16 different crypto assets including Cosmos, Algorand, Tezos, Dash, Decred, Orbs, Horizen, Livepeer, EOS, Factom, Loom, Iris, Terra, Dai, and USDC.

Have questions? Find time to speak here.

Learn more and get started here!

About Staked

Staked helps institutional investors reliably and securely compound their crypto by 5% — 100% annually through staking and lending. Staked runs validation nodes for proof-of-stake currencies and offers access to on- and off-chain lending options that provide an annualized yield of in-kind currency.

If you enjoy Seeking Yield or are a fan of what we are building at Staked, give us a shout on Twitter, LinkedIn, or tell your friends and colleagues.

Website | Twitter | LinkedIn | Medium | Newsletter | Careers